Crypto wallets are innovating for greater control

How crypto wallets are becoming their own on-ramp, redefining the role they play in payments.

For years, the go-to approach for cryptocurrency wallets offering fiat-to-crypto card purchases has been to integrate a third-party on-ramp, a separate service that enables users to convert traditional currency into cryptocurrency. These services handle know-your-customer, compliance, card payments and crypto delivery, making them a fast and low-effort solution for wallets.

This simplicity, though, comes at a cost.

Trade-offs of third-party on-ramps

Third-party on-ramps are convenient, but they can introduce friction and inefficiency that can hold wallets back. Those include:

- Loss of UX control. Sending users to an external checkout interrupts the in-app experience and can cause confusion, especially when users are asked to go through KYC after they’ve already completed it in the wallet. The extra steps lead to higher drop-off rates.

- Low authorization rates. Most on-ramps process transactions through a shared merchant account. This means that if another wallet or Web3 business sharing the same merchant account experiences fraud or chargebacks, it can drag down approval rates for everyone. Even wallets with clean, legitimate traffic often see authorization rates well below industry averages.

- Higher fees. Many on-ramp solutions come with high fees, often ranging from 4.5% to 8% per transaction. That’s significantly higher than wallets typically pay when working directly with a payment processor. These extra costs not only reduce margins, they also discourage larger user deposits.

Why wallets use on-ramps

Despite their downsides, on-ramps have played a major role in driving fiat-to-crypto transaction volume, and continue to offer a practical solution for crypto businesses, particularly during early growth stages. Over the past five years, most centralized crypto exchanges have shifted from on-ramps to direct relationships with payment providers. Now, large wallets are the next group likely to make that transition.

For Web3 businesses, becoming a merchant of record means being responsible for processing payments, handling chargebacks and complying with relevant financial regulations. While it can offer greater control and better margins, it also comes with a number of requirements, including fraud prevention, payment infrastructure and customer support. For many crypto businesses, especially in earlier stages, the benefits may not outweigh the complexity.

Here are some of the key challenges involved:

- Licensing. Offering fiat-to-crypto services means navigating regional financial regulations. In the United States, for example, this means acquiring money transmitter licenses in each state. Securing these licenses takes time, legal resources and dedicated compliance expertise. For most wallets, building out that infrastructure from scratch isn’t practical.

- Compliance requirements. Being the merchant of record means handling anti-money laundering and KYC at the transaction level, including identity checks and monitoring suspicious activity.

- Risk and liability. Accepting fiat payments also means accepting liability for fraud and chargebacks. Third-party providers offer built-in fraud prevention and handle chargebacks directly.

Exodus takes different approach

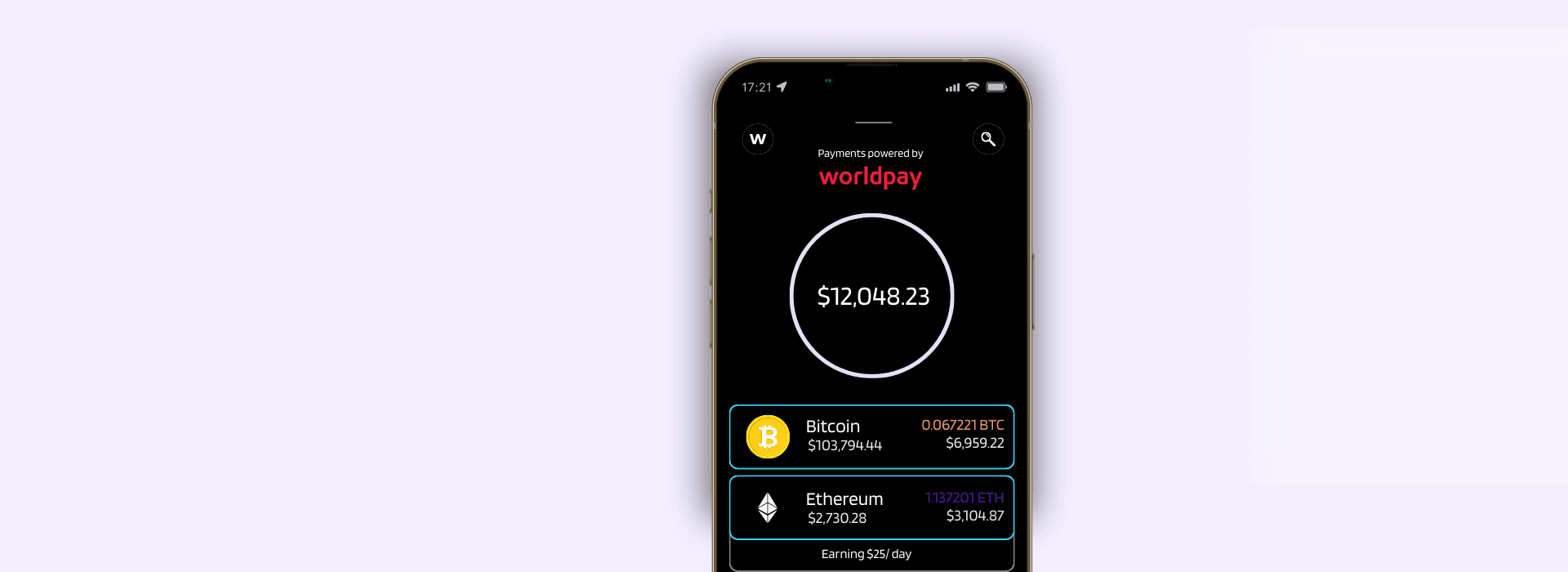

Exodus saw these challenges but took a different route. Rather than continuing with third-party providers, its team built XO Pay, a fully integrated fiat on-ramp, and became its own merchant of record.

Exodus partnered with a licensed crypto-as-a-service provider to fulfill regulatory requirements. This gave it access to nationwide U.S. licensing and allowed it to share anti-money laundering and KYC responsibilities while maintaining compliance.

Exodus also worked directly with Worldpay to process card payments through its own merchant account. This gave Exodus full control over payment performance, along with access to crypto-specific fraud tools and payment advisory services.

Worldpay played a critical role in helping Exodus make the move to becoming a merchant of record. We offered:

- Advisory support on setting up risk thresholds and configuring fraud tools.

- Crypto-specific fraud tools like FraudSight.

- Ongoing guidance on optimizing payment flows for better authorization rates.

- Real-time visibility into approval data and chargeback patterns.

Worldpay’s experience with crypto businesses helped Exodus set up a tailored, secure and high-performing payment flow.

A better chargeback landscape

Chargebacks have long been a challenge for wallets handling card payments, but recent updates from Visa and Mastercard have started to reduce this risk for crypto transactions.

With proper authentication and clear disclosures, verified crypto transactions are much less likely to result in a chargeback. In many cases, if the cryptocurrency is delivered and the user has been informed, the transaction can’t be reversed.

These changes, along with strong fraud tools and guidance from partners like Worldpay, make it much easier for wallets to manage risk as a merchant of record.

The takeaway for crypto wallets

Exodus has proven that crypto wallets can successfully make the transition to becoming their own merchants of record. With the right partners in place, wallets can:

- Offer a seamless, fully in-app experience.

- Improve card approval rates and reduce user drop-off.

- Lower transaction fees.

- Gain visibility and control the entire user payment process.

Together, these benefits make it easier for wallets to increase digital asset purchases and drive long-term growth.

Thinking about becoming a merchant of record?

Worldpay works with crypto wallets and other crypto and Web3 businesses to support the full merchant of record transition, offering tailored support, fraud tools built for crypto, and deep expertise in navigating card networks and compliance. Find out more.

Related Insights